Forex trading, also known as foreign exchange trading, is a dynamic and complex financial market where currencies are bought and sold. To navigate this intricate landscape, traders employ various tools and metrics, with one of the most fundamental being "pips." In this article, we'll explore what pips are, their significance in forex trading, and how traders leverage them to make informed decisions.

What Are Pips?

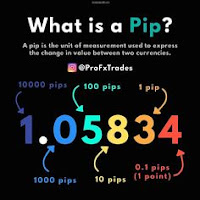

The term "pip" stands for "percentage in point" or "price interest point." Pips are the smallest price movement that can occur in the exchange rate of a currency pair. In most currency pairs, a pip is typically expressed as a standard unit of movement, usually the fourth decimal place in the exchange rate. However, in some currency pairs, such as those involving the Japanese Yen, a pip is the second decimal place.Understanding the Value of a Pip

The value of a pip is crucial for forex traders as it helps them quantify price movements and calculate potential profits or losses. The monetary value of a pip depends on the size of the trader's position and the exchange rate. To illustrate this, let's consider an example:

Suppose you have a standard lot (100,000 units) of EUR/USD, and the exchange rate moves by one pip. If the quote currency is the USD (as in the case of EUR/USD), the value of one pip can be calculated using the following formula:

For a standard lot of EUR/USD, where the pip value is typically $10, the calculation would be:

\text{Value of One Pip} = \frac{100,000 \, \text{units} \times $10}{\text{Exchange Rate}}

This formula allows traders to understand the monetary implications of price movements and make informed decisions about their trades.

Significance of Pips in Forex Trading

Measuring Price Movements: Pips provide a standardized way to measure and express the changes in currency pair prices. Traders use pip movements to analyze historical price data, identify trends, and make predictions about future market movements.

Risk Management: Understanding the value of a pip is crucial for effective risk management. Traders can set stop-loss orders and take-profit levels based on pip values, helping them manage and limit potential losses.

Calculating Profits and Losses: Pips play a vital role in calculating the potential profits or losses of a trade. By knowing the value of a pip and the size of their position, traders can estimate the impact of market movements on their account balance.

Setting Targets and Stops: Traders often set profit targets and stop-loss levels based on specific pip values. This approach allows for a disciplined trading strategy and helps traders stick to their risk-reward ratios.

Conclusion

In the world of forex trading, understanding pips is essential for making informed decisions and managing risk effectively. Pips provide a standardized measure of price movements, allowing traders to quantify changes in currency pair values and calculate potential profits or losses. Aspiring forex traders should familiarize themselves with the concept of pips and incorporate this knowledge into their trading strategies to navigate the dynamic and competitive forex market successfully.